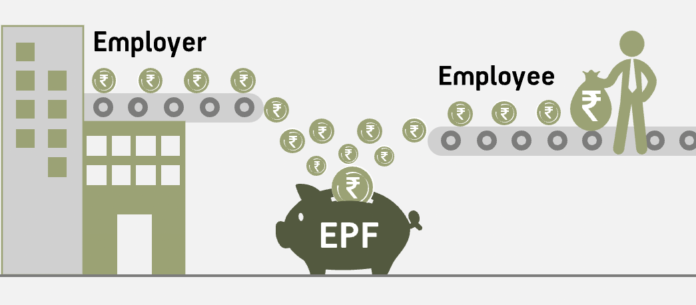

Employee provident fund refers to the financial product to save funds for your retirement days. Both employees and employers contribute to this scheme. EPF India is one of the largest retirement schemes. Read about EPF in detail here.

What’s EPF?

The full form of EPF is the employees’ provident fund. This is a retirement benefits scheme wherein both the employee and employer contribute equally to this financial scheme. Both must put in nearly 12 per cent of the basic income to this fund. During retirement, you as an employee will get the lump sum fund and the interest earned on it.

How does the EPF scheme function?

In this EPF scheme, both employer and employee must contribute towards this fund. The contribution must be in-tune with 12 percent of the basic salary with the dearness allowance that you receive in your account. However, not all the employer’s contribution is moved towards EPF. You as an employer must contribute nearly 3.67 percent of 12 per cent of this fund. The remaining 8.33 percent is headed toward the EPS (employee pension scheme). Note that, you must know your EPFO member login details to log in to your EPF account to check your balance and the amount received. In case, you do not have the EPFO member login details, then you may approach your company HR for the same or you may look up your salary slip for the details.

What’s the benefit of EPF?

There are various benefits to investing in the EPF (Employees Provident Fund). Read on to know the benefits –

Capital appreciation

There’s a fixed interest rate available in the EPF scheme. Additionally, the EPF even earns the interest constituent when lying dormant.

Corpus for the emergencies

Owing to a specific premature withdrawal regulation, you may consider EPF as an emergency corpus.

Retirement corpus

A major reason for you to invest in EPF is to avail a retirement corpus. Corpus endows you with high security.

Tax saving scheme

EPF falls under Section 80 C of the IT Act. Thus, even the earnings from the EPF scheme are tax-exempt. Thus, there are several benefits to making the EPF contribution.

What’s the eligibility parameter for EPF?

The eligibility parameter for EPF are as follows –

- Any company with over 20 employees or staff must register with EPFO.

- Companies with below 20 employees can even register for EPF voluntarily.

- All the employees drawing an income are eligible for the EPF.

- Additionally, it is mandatory for all employees earning below Rs 15,000 to register for EPF. Note that employees earning over Rs 15,000 too can voluntarily remain in the EPF scheme.

The above was the EPF eligibility rules, which you must beware of.

What’s the rate of interest on EPF?

The rate of interest on EPF is 8.1 percent according to the EPFO norms.

How’s the interest constituent computed on the EPF?

If you are one of those conducting an EPFO establishment search and want to know about how to compute the EPF interest constituent, read here. However, remember that the interest constituent is computed towards the end of the year. The interest rate is divided into monthly, and that amount is paid to you.

How to compute EPF (employees’ provident fund)?

Remember to visit the official website of the EPF to know how your EPF is computed. Read on here –

Employee’s contribution –

No matter what your income is, the contribution towards the provident fund equals 12 percent of the basic pay and dearness allowance. Employee contribution towards EPF equals 12 / 100 X (basic + dearness allowance).

Contribution of the employer –

Employer contributions towards the provident fund are as follows –

Employer’s contribution toward employee provident fund = 3.67 / 100 X (Basic + Dearness Allowance)

8.33 percent goes towards employee pension schemes.

Example of employee provident fund contribution –

Suppose employee X earns a monthly income of Rs 15,000 per month, then the employee contribution would be Rs 1,800 per month as per the computation mentioned above. Employee contribution towards EPF means 12/100 X Rs 15,000 = Rs 1,800. Employer’s contribution would equal Rs 550 per month i.e., 3.67 / 100 X Rs 15,000 = Rs 550.50.

What are the distinct kinds of EPF forms required?

Different EPF forms required include –

| Form name | Form requirement |

| Form 2 | For nominating & declaring the nominee |

| Form 5 | For registering for the EPF and EPS |

| Form 5 IF | Fill out this form to get the claim for EDLI scheme |

| Form 10 C | This form is a must for getting the withdrawal benefit and scheme certification |

| Form 10 D | This is a monthly form that allows you to get monthly pension |

| Form 11 | Using this form, you can transfer your EPF account |

| Form 14 | With this form, you can buy a LIC policy |

| Form 15 G | This form is a must to get the tax-saving benefits on interest constituent |

| Form 20 | This form is required to settle your EPF when the holder is dead |

| Form 31 | This is a must for withdrawing the EPF amount |

What are the EPF tax rules and regulations?

EPF i.e., employee provident fund is a EEE financial instrument. Thus, it is tax-exempt on withdrawal. Moreover, contributions and interest constituents received are even tax-exempt. However, there are scenarios, wherein EPF may be taxable. These include –

- It’s taxable if the employee’s contribution toward EPF surpasses Rs 7.5 lakh in a financial year. Note that, an employee holds the liability to pay the tax on an amount that surpasses Rs 7.5 lakh.

- If the excess contribution from the employee end to EPF surpasses Rs 2.5 lakh in a financial year, then the interest earned on the additional amount is taxable.

- In the case there’s zero employer contribution to the EPF account, which is the scenario for government staff, then the interest constituent will be exempt from tax on the amount of up to Rs 5 lakh in a financial year.

- Interest constituent generated on the inactive EPF account is taxed in the hands of the employees.