We all know that the prospects for the whole market have decreased because of things like demonetization, the introduction of GST, and the NBFC liquidity problem. Due to investors’ pursuit of momentum bets during the last several years, the market’s growth has become polarised. And funds have tried their investors’ patience by underperforming severely in the previous three years compared to other categories. Some benefits of the funding include:

Increased Returns

Longer investing horizons may provide significant returns, but perseverance is essential! And here is where the majority of individual investors fall short. One of the top mutual funds to invest in for 2021 is SBI Small Cap Fund. You would be shocked to learn that the fund earned returns of -19.62% between December 29, 2017, and December 31, 2018. Only in the following year, or between December 31, 2018, and December 31, 2019, did it create a profit of +6.1%.

Most small-time investors would liquidate this fund after such disappointing results; however, it would be a grave error. Because the SBI Small Cap fund had a fantastic +33.62% return between December 31, 2019, and December 31, 2020. Therefore, one of the critical benefits of long-term investment is that, if you have patience, you may earn significantly more significant returns while reducing medium volatility.

Risk acceptance

Investing for the long term is comparable to playing a test match or running a marathon. The fund manager, who represents the batsmen, is not concerned with placing short bets. Instead, he is more concerned with the fundamentals of the equities that the fund is purchasing. This fuels the conviction to hold onto the stock even through a difficult period or year. Even if the fund management makes a mistake in their judgement, they may still replace low-quality holdings or remedy their error. By doing this, they minimize the short-term negative effect on the portfolio and offset this drawback with long-term advantages.

Tax Advantage

There are tax repercussions if you often purchase and sell mutual funds. In a mutual fund plan, the capital gains are distributed to the unitholders even if the fund management usually buys or sells the underlying equities. In most cases, the profits you receive by often moving funds aren’t worth more than the taxes you have to pay. Long-term investment stands out in this regard.

You instantly save up to 5% more tax when you keep a fund for more than a year. A flat 15% short-term capital gains tax is due when you sell an equity fund before the year has passed (STCG). However, if you sell an equity fund after a year, you will only be required to pay 10% long-term capital gains tax (LTCG) if your profits exceed Rs 1 lakh. You don’t pay any tax if your long-term profits are less than Rs. 1 lakh. So, you may reduce your tax liability by 5% to 15% by making long-term investments.

Ability to compound

The second key to Warren Buffett’s huge riches is the power of compounding, which is also known as the world’s eighth wonder. Of course, investing for the long term comes first. Less Dependence on Star Fund Manager But remember, the force of compounding only works if you don’t churn your portfolio often.

Investing in the top mutual funds for SIP with a proven track record and stock selection procedures is one of their main advantages of investing in them. Over the years, this procedure has been tried, tested, and refined. Therefore, even if the star fund manager departs, the fund will not suffer, and the fund is independent of the fund manager’s whims and preferences.

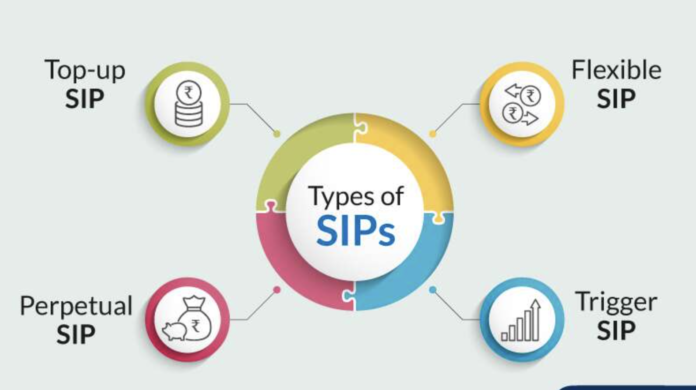

Invest in a fund with a well-diversified portfolio of companies and industries to lessen the effects of any possible risk. Clearly define your objectives, risk tolerance, and investment horizon before making financial decisions. Last but not least, when investing in mutual funds, choose the Systematic Investment Plans (SIP) option to reduce volatility, average out investment costs, and maximize profits via compounding.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.